Surf Protocol

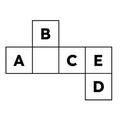

Surf Protocol is the first permissionless derivative exchange, enabling trading and listing of over 10,000+ assets. Built on Base. On Surf, Liquidity Providers (LPs) voluntarily provide liquidity and assume the other side of traders' positions for any specific asset. Unlike traditional perpetual dexes where Liquidity Providers (LPs) share a single pool to act as the counterparty for traders, Surf operates differently by assigning each asset its own pool. This structure not only segregates the risk among different assets, ensuring that they are all independent, but it also broadens the opportunity for liquidity bootstrapping for newly issued assets. For each asset, LPs have the flexibility to select from five different fee options. The pools with the lowest fees are matched against traders before the high fee pools. This innovative design encourages LPs to strike a balance between risk (being the first to be matched against traders) and return (in the form of fees). In this scenario, LPs are in a healthy competition, continuously balancing risk and reward. Our design is driven by a goal to offer traders a broad range of tradable assets at the most competitive fees possible. We aspire to create an environment where diversity of choice and cost-effectiveness come hand in hand.